Where Should a Beginner Start?

Worst Contrarian receives a dm and shares his answer.

Hello my dear reader,

I received a DM and want to write a post answering the question.

This article is going to be explaining to fish as opposed to catching one for you.

I could write a post giving you a trade but what good is that? Soon it would be gone and you’d be asking me for another.

This message was sent to me by a long time reader and friend of the blog:

“Hi, just saw your last posts and it intrigued me and made me want to ask you since you seem like an old guy that has seen things.

Where would you start the « exploration phase » for someone that has just done basic saving+investing stocks and indexes? (160K in IBKR and other stuff in gov saving accounts). I suppose you won’t give me your edge just like that but just general tips of how and where I should search/study.

Also which platform(s) you would use? Crypto or staying with stocks is ok (scared of hedge fund competition eating all the alpha)? I kind of block at the exploration step since” end message.

Okay a lot to take in here.

Lets break this down piece of piece. Starting with the most important part of the message.

The Sender

Before we charge ahead we should investigate the profile of our friend who sent the message.

Okay lets go through the checklist for this guy:

Has a full time job which we can assume pays decently

He can trade at night while he learns the ropes

Understands that he won’t be punting on charts and needs edge

Has enough cash that should he find edge he could probably scale it up

If it doesn’t work he had alternatives

Seems like a guy who could do okay?

The only thing I would say is, and I have stressed this before, starting a business has less volatility, less risk and I believe (provided you are willing to work hard) a higher chance of success.

Sidenote: I outlined the cons of trading in a recent post titled: “So You Want To Trade For A Living?” Link here.

Starting a business is a lot of work though so if this guy can only commit 2 hours a night, maybe trading is a better option? I am not sure.

Maybe I will do a post comparing the workload of trading vs running a business & the pros and cons.

Comment if it is of interest.

“You seem like an old guy that has seen things”

Man what the hell I am only 30.

“Where would you start the exploration phase?”

I think the sender is on the right path by looking for inefficiencies to exploit. I think going this route will lead to a higher probability of success rather than the ‘traditional trader’ route.

I would urge him to read everything Robot James has written.

He has a series of threads about trading. This one could be a good start, link here.

I think there are two ways a new trader can make money.

Providing services

Finding inefficiencies

Providing Services

Providing services is doing trades that are useful to other people, these trades pay because you are (kind of) doing them a favour. You (generally) make money on these trades because if you are providing a service (usually) the service receiver pays.

Think of selling volatility. You are basically selling insurance.

However, VIX futures can jump 100% in a day.

It doesn’t happen often, but perhaps for a macro dilettante that sees danger looming on the horizon the VIX futures can be a good way to express his view.

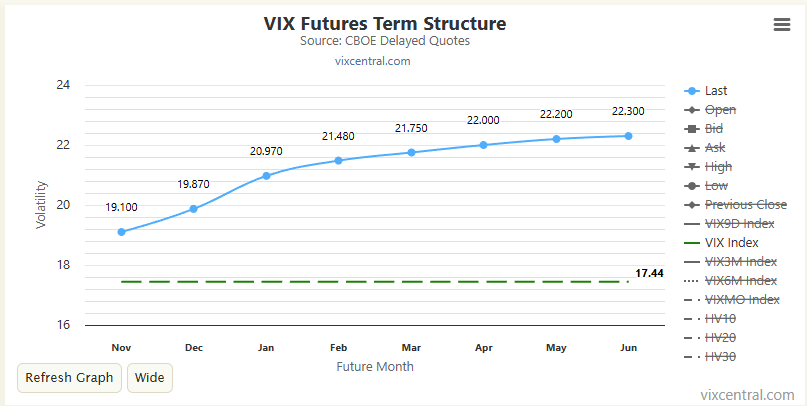

The problem for our macro trader is that the VIX futures are usually in contango, meaning, for a buyer it has a negative cost of carry.

Looked another way, if you sell VIX futures you (usually) receive positive carry.

This intuitively makes sense as why would an insurance company pay you to take out insurance?

The VIX term structure as of the 2/11/2025 can be seen below.

Suppose the event the macro trader anticipates huge fizzles out and nothing happens. He will almost certainly lose money.

This is a basic example of providing a service in the markets. You are kinda doing things others don’t want to do and being paid for it.

Another example along the same lines is doing cash and carry trades.

Imagine you are a Fartcoin enthusiast. You have watched hours of Tiktok videos, scrolled Twitter, glanced over at least 4 ‘trading’ forums.

You have come to the logical conclusion that a partnership with a laxative company is imminent. This will undoubtedly catapult Fartcoin to new highs.

You stay awake at night struggling with what you will do with your new found wealth. You have always wanted a Lamborghini but now you are a bit older so maybe a Ferrari would suit your personality more.

You do some research and come across a little known discovery, a product called “perpetual futures”. Perpetual futures also known as perps allow you to use leverage to magnify your gains or losses.

Given the thorough research you have undergone, leveraging up your account by a modest 10x seems like a logical choice.

The only problem is Fartcoin is in high demand, everyone wants to own it. As a result the perp is trading at a premium to the spot.

Perpetual futures can trade at a higher or lower price than the underlying market. The mechanism that ties the perp to the spot market is the ‘funding rate’.

You are not a math nerd but you piece together that if you want to buy a Fartcoin perp on leverage you will have to pay roughly 5% a week in funding.

“5% a week” you scoff as you shake your head, “That is NOTHING compared to the 100x that this baby is about to do.”

You immediately market buy as much as you can.

Question for the reader: If you are short a perp and you are PAYING funding, is the perp contract trading above or below the spot price?

.

.

.

.

.

Answer: below.

A video covering perps and funding can be found here.

However, a third party emerges from the fog, our hero, the humble ‘cash and carry trader’.

The cash and carry trader immediately works out that he can buy 100k worth of Fartcoin in the underlying (spot) market and sell 100k of perpetual futures. Suppose he uses 20% leverage on the perps so his total outlay is 120k.

He has a 100k position with 5% funding so he would make 5k a week or a 4.16% return a week. Not bad

What service is the cash and carry trader providing to the market? Leverage.

By selling the perps short he is lowering the price of the contract thus making it cheaper for the longs to own it.

That isn’t to say this trade is risk free.

The crypto financial thoroughfares are littered with fools who have lost money doing this simple trade, the author included.

See “Losing 150k on My Wife’s Birthday” for more info, link here.

NOTE: This is not an endorsement to sell the VIX short or do cash and carry trades. I am just trying to give the reader and idea of trades that can ‘provide a service’.

The reader may have noticed that I haven’t provided an example of finding inefficiencies or ‘alpha’ trades.

I wrote about inefficiencies at length and even gave an example in my post “How I Structure My Portfolio (Risk Premia/ Active Strategies/Alpha) - With Examples” Link here.

I want to make another post solely discussing it so wait out.

“Also which platform(s) you would use?”

This is something I see beginners ask a lot. It is kind of like asking a runner what shoes they use.

It doesn’t matter, I use whatever works.

In crypto there are exchanges to avoid but if you stick to the major ones you should be fine.

“Crypto or staying with stocks is ok (scared of hedge fund competition eating all the alpha)?”

Maybe start off with crypto as it is kind of ‘easier’ if you can call it that.

I mainly trade tradfi now but prior to having a kid I almost exclusively traded crypto as I found tradfi too competitive.

Final thoughts

I enjoyed this “Letters to WC” format.

If you write to me and I think I can answer your question, I will likely do a post like this.

Please feel free to DM me on here should you have a question you’d like me to answer.

Thanks for reading the Substack, I know this post was a little different but I hope you enjoyed it.

You friend always - Worst Contrarian

This is a real gem of a post. In my experience, once you figure out how the sausage is made, it gets a lot easier to find new edges.

Maybe in future you could talk about ‘how there’s only so many trades’ and it’s just a game of applying these ‘trades’ to novel situations

Cracking stuff bro